Blog

6 Top Tips for Using Crypto Beyond Trading

Most people meet crypto on a price chart. Buy, sell, repeat. But there’s a lot more to it than watching candles move. Digital currencies and the networks behind them can help you move money across borders, pay for things online, join communities, and even prove where a product came from. Think of this as a practical tour: six ways to put crypto to work in everyday life, without needing to be a day-trader or a developer.

Accept (or make) online payments the modern way

More small businesses are adding a “Pay with crypto” button because settlement can be near-instant, and chargebacks are less of a headache. If you sell digital goods, subscriptions, or freelance services, offering a stablecoin option can open doors to customers who don’t use your local currency. If you’re on the buyer’s side, paying in crypto can be cleaner for cross-border purchases. The practical steps are simple: pick a wallet, decide how you’ll convert to your local currency (if you need to), and keep basic records for taxes.

If you want to see how consumer platforms stress-test these rails at scale, look at the crypto-casino space. Sites compete on smooth checkouts, quick withdrawals, and broad coin support, plus player-friendly extras that keep people coming back. For a useful overview, PokerScout KR compares crypto-friendly casinos that feature huge game libraries, rapid payouts across multiple tokens, and recurring promos like welcome offers, free spins, and cashback, handy context if you’re evaluating what “good” looks like for crypto payments in the wild.

Send money across borders without the usual friction

If you’ve ever tried wiring money internationally, you know the drill: waiting days, paying fees you only notice at the end, and dealing with exchange rates that never feel friendly. With a compatible wallet and a stablecoin, you can send value directly to someone in another country in minutes. It’s not magic, though. Fees still exist, and you need to choose the right network, but it often beats the slow, costly route. Agree on which token and chain you’ll use, test with a tiny amount first, then send the rest once you’re both confident it works.

Earn yield carefully with staking and lending

Leaving tokens idle is like letting cash sit under the mattress. Staking lets you help secure certain networks and receive rewards.

Crypto lending platforms, on the other hand, match lenders and borrowers, paying interest to the former. Both can be useful, both carry risk.

Treat them like financial products, not free money. Read audits, learn how the platform manages collateral, and start small.

If the returns sound too good to be true, they probably are. Your rule of thumb: understand how the yield is generated before you chase it.

Try tokenised access instead of pure speculation

Not every token is meant to be “money.” Some act more like keys. Hold one, and you can use a piece of software, unlock premium features, or vote on how a project evolves. If you’re drawn to a tool, game, or community, using its token for access can make more sense than buying it to flip later. You’re paying for the utility you actually want, plus you may get a say in future updates. Just check the basics: what can you do with the token today, and who’s responsible for delivering tomorrow’s roadmap?

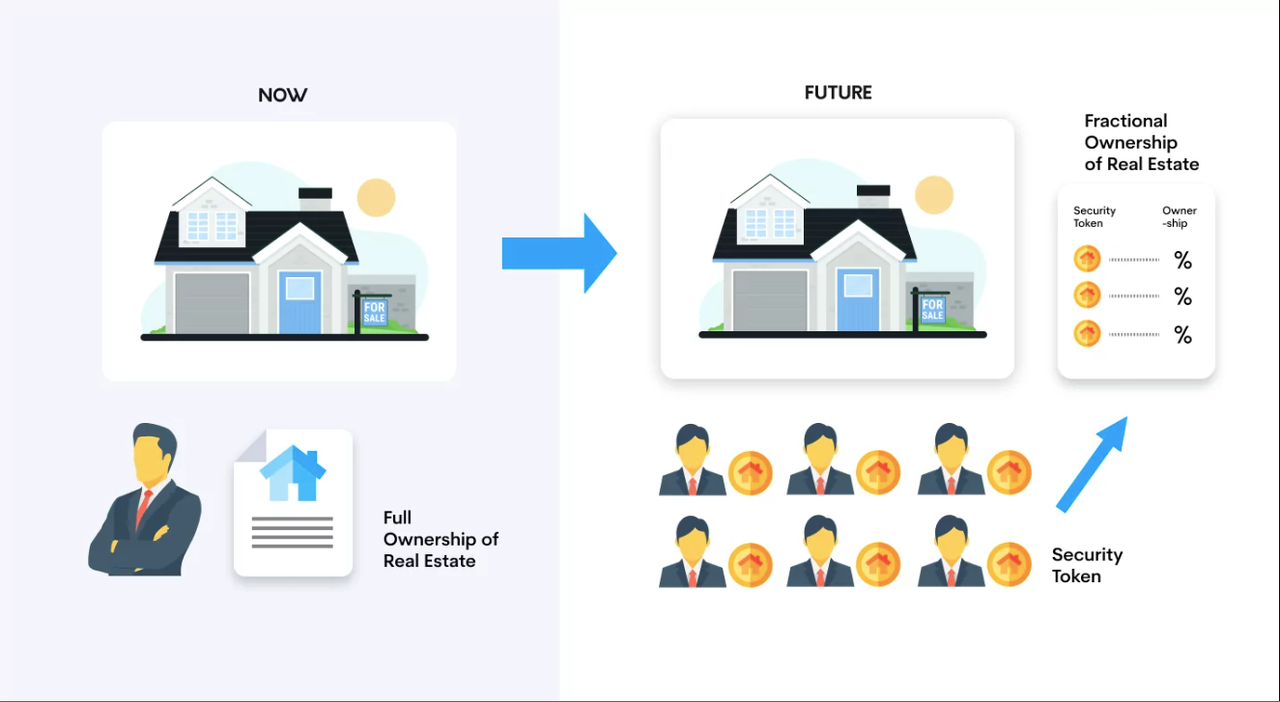

Explore asset tokenisation: fractional ownership, real rules

- This is where the idea gets exciting: turning real-world assets into digital tokens so more people can own a small piece.

- Property funds, art, commodities, and tokenisation can lower entry barriers and improve liquidity. That said, it isn’t a shortcut around reality.

- There are still rights, regulations, and managers behind the scenes.

- Before you buy a slice of anything, look at the legal wrapper, how ownership is recorded, how you sell later, and which fees apply.

- Treat tokenised assets like you would a traditional investment, just with a different wrapper.

Put security, taxes, and local rules front and center

Whatever you do, safety comes first. Use reputable wallets. Back up your recovery phrase offline. Turn on two-factor authentication. Watch for fake apps and phishing links that mimic real services. On the housekeeping side, keep simple records of what you sent or received and why; it makes tax time far less painful. Laws differ by country, so check how your jurisdiction treats payments, staking rewards, or token sales. When in doubt, ask a professional. Calm, consistent habits do more for your long-term results than any hot tip ever will.

Conclusion

Crypto doesn’t have to be a roller-coaster of trades. It can be a faster way to pay overseas suppliers, an extra checkout option for your shop, a method to earn measured rewards, a ticket into useful software, a bridge into fractional ownership, or a trusted record of who did what and when. None of these demands requires blind faith. It asks for the same basics that make any tool work: start small, learn as you go, and protect yourself. Do that, and you’ll find there’s a life for crypto beyond the chart, one that’s practical, steady, and built for everyday use.